We construct two aggregate liquidity indicators for Bursa Malaysia at daily, weekly and monthly frequencies. The description and time series properties of the new indicators are provided by Liew et al. (2016). Our subsequent research shows the great potential of such indicators, and we hope our work will stimulate more macro research on the aggregate market liquidity of the local bourse.

Research Funding

- Dec 2014−Aug 2017 Completed

Fundamental Research Grant Scheme (FP020-2014B), MYR87,850

- April 2017−Sept 2018 Completed

Volatility and Liquidity of the Malaysian Stock Market

UM BKP Special (BKS016-2017), MYR12,600

- Sept 2018−Sept 2019 Completed

Does Having More Investors Lead to Higher Stock Liquidity? Evidence From Malaysian Public Listed Firms

Population Studies Unit Grant (IF002-2014), MYR3,000

Human Capital

Yee-Ee Chia

PhD (Sept 2015−May 2020), Stock Liquidity of Malaysian Public Listed Firms

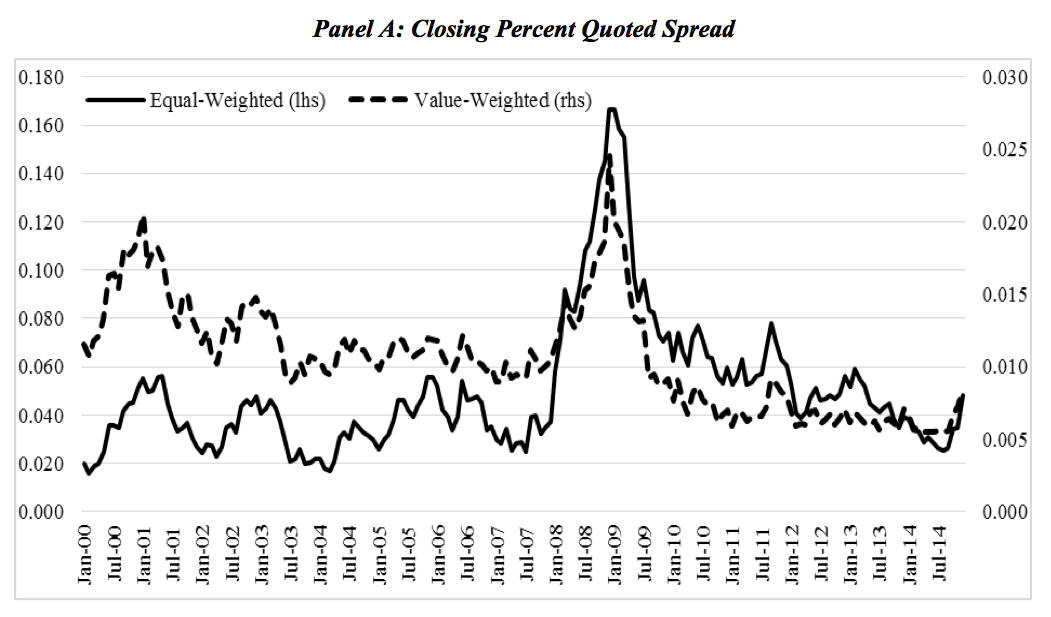

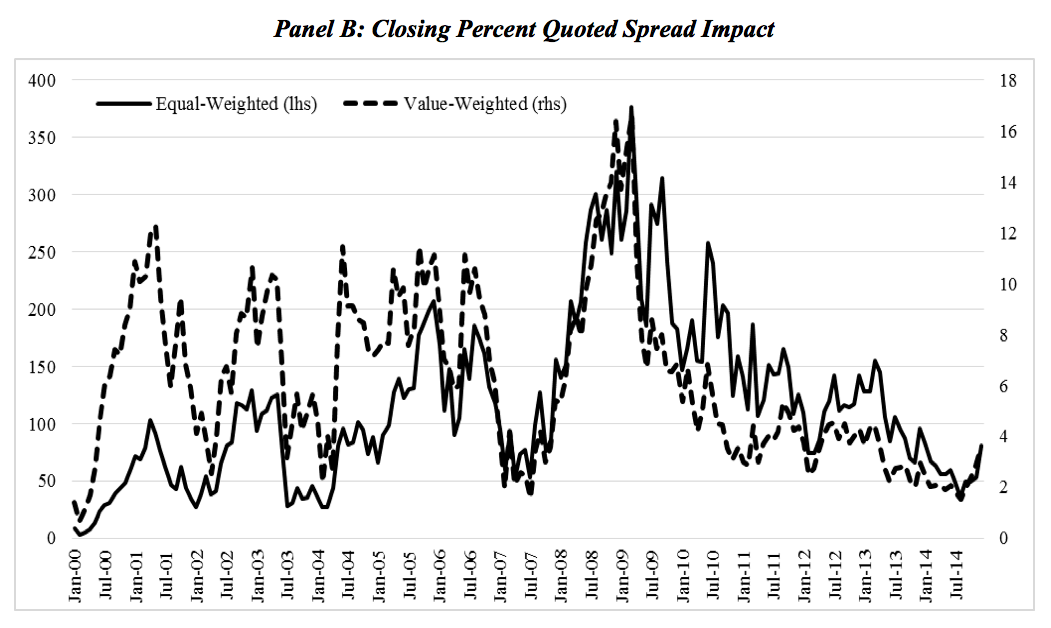

Yee-Ee’s PhD advocates Closing Percent Quoted Spread (CPQS) as the main liquidity measure for Malaysian public listed firms. Her thesis places CPQS as dependent and independent variables. In the first case, she determines the explanatory power of a new variable- the number of shareholders. As an independent variable, her research explores the effect of liquidity on firm value.

Ping-Xin Liew

Master of Economics (Feb 2014- Feb 2016), An Empirical Analysis of the Liquidity of the Malaysian Stock Market

PhD (Sept 2016− Jan 2021), Aggregate Stock Liquidity of Bursa Malaysia

In the research paper of her MEc, Ping-Xin constructs market-level liquidity measures for the Malaysian stock market by aggregating firm-level estimates at different data frequencies. After completion, she extends her liquidity research to PhD level. Her thesis derives policy insights from the constructed aggregate market liquidity by addressing issues on foreign portfolio flows, day trading and cross-markets liquidity connectedness.

Research Output

Aggregate liquidity for Malaysian stock market: New indicators and time series properties

Investor heterogeneity, trading account types and competing liquidity channels for Malaysian stocks

Foreign equity flows: Boon or bane to the liquidity of Malaysian stock market

Does proprietary day trading provide liquidity at a cost to investors?

Liquidity and firm value in an emerging market: Nonlinearity, political connections and corporate ownership

The dynamics and determinants of liquidity connectedness across financial asset markets

Aggregate Liquidity Indicators for Bursa Malaysia