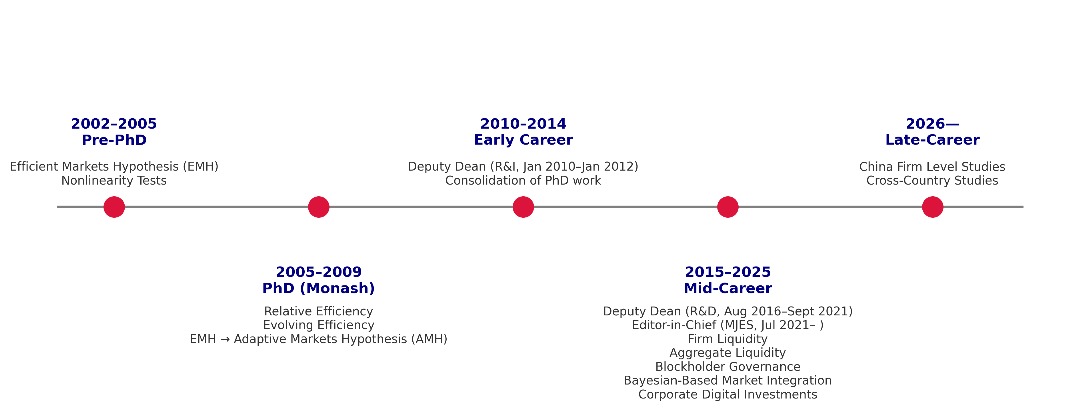

Kian-Ping Lim is an Associate Professor at the Faculty of Business and Economics, Universiti Malaya, Malaysia. He holds a B.B.A. (Hons.) in Finance from Universiti Kebangsaan Malaysia, an M.Sc. in Financial Economics from Universiti Putra Malaysia, and a PhD from the Department of Econometrics and Business Statistics, Monash University.

The research of Kian-Ping is largely published in mainstream economics and finance journals. Among them are Applied Economics Series (Applied Economics, Applied Financial Economics, Applied Economics Letters and Applied Financial Economics Letters, Taylor & Francis), Economic Modelling (Elsevier), Economics Letters (Elsevier), Emerging Markets Review (Elsevier), Journal of Economic Surveys (Wiley-Blackwell), Journal of Emerging Market Finance (Saga), Journal of Empirical Finance (Elsevier), Journal of International Financial Markets, Institutions and Money (Elsevier), Journal of Policy Modeling (Elsevier), International Review of Financial Analysis (Elsevier), Macroeconomic Dynamics (Cambridge University Press), Manchester School (Wiley-Blackwell), North American Journal of Economics and Finance (Elsevier), Research in International Business and Finance (Elsevier) and Singapore Economic Review (World Scientific).

Beyond research, Kian-Ping contributes actively to academic leadership and service. He is currently the Editor-in-Chief of the Malaysian Journal of Economic Studies, the flagship publication of the Malaysian Economic Association). He was the Deputy Dean (Research & Innovation) at the Labuan School of International Business & Finance, Universiti Malaysia Sabah (Jan 2010–Jan 2012), and later the Deputy Dean (Research & Development) at the Faculty of Economics & Administration, Universiti Malaya (Aug 2016–Sept 2021). In these capacities, he helped to promote research in business and economics, supporting an environment where scholarship can grow.